Certification of Advanced Equipment Introduction Plan Based on the Small and Medium-Sized Enterprise Management Enhancement Act

[Points to Note on System Changes Accompanying the FY2025 Tax Reform]

With the FY2025 tax reform, the requirements and contents of the special measures for Property Tax have been revised. Additionally, due to amendments to the regulations related to the Advanced Equipment Introduction Plan under the Enforcement Regulations of the Act on Strengthening the Management of Small and Medium Enterprises, effective April 1, 2025, the formats of the Application Form and related documents have been changed.

Note: Please be aware that applications in the old format cannot be accepted.

About the Advanced Equipment Introduction Plan

The "Advanced Equipment Introduction Plan" is a plan established by small and medium-sized enterprises (SMEs) as defined under the Act on Strengthening Small and Medium Enterprises, aimed at improving labor productivity through capital investment. In Inagi City, consent for the "Basic Promotion Plan" was obtained from the national government on April 1, 2025, and the city certifies the "Advanced Equipment Introduction Plans" formulated by SMEs within the city.

If certified, you can receive tax and financial support as follows.

Support Details

(1) Tax System Support (Property Tax Special Provisions for Depreciable Assets Contributing to Productivity Improvement)

Based on the "Advanced Equipment Introduction Plan" certified by the Mayor of Inagi City, if small and medium-sized enterprises introduce new equipment that contributes to labor productivity improvement within the applicable period, they can receive the following Property Tax measures for that equipment. Please note that those without a wage increase declaration are excluded.

Note: The application period is from April 1, 2025 to March 31, 2027 (2 years)

| Item | Contents |

|---|---|

| Eligible Individuals | Corporations with capital of 100 million yen or less, sole proprietors with 1,000 or fewer employees, etc., who have received certification for the Advanced Equipment Introduction Plan (excluding subsidiaries of large corporations). |

| Target Equipment Note: Limited to those taxed as depreciable assets |

Those that meet the following two requirements

Requirements by Type of Depreciable Assets (Minimum Acquisition Price) 1. Machinery and Equipment (1.6 million yen or more) 2. Measuring and Inspection Tools (300,000 yen or more) 3. Fixtures and Fittings (300,000 yen or more) 4. Building Attached Equipment (600,000 yen or more; excludes those taxed together with the building) |

| Other Requirements |

・Must be directly used for activities such as production or sales ・Must not be a used asset |

| Tax Measures |

・If a wage increase of 1.5% or more is declared: Tax base is reduced by half for 3 years ・If a wage increase of 3% or more is declared: Tax base is reduced to one-quarter for 5 years However, this is limited to equipment acquired by March 31, 2027. |

(2) Financial Support

Small and medium-sized enterprises can receive additional guarantees separate from the usual framework of ordinary insurance through the Credit Guarantee Association when obtaining loans from private financial institutions for the implementation of the "Advanced Equipment Introduction Plan" certified by Inagi City. If you are considering utilizing this, please consult with the relevant organizations before applying for certification of the "Advanced Equipment Introduction Plan."

The related organizations are as follows.

Tokyo Credit Guarantee Association (Phone) Hachioji Branch 042-646-2511

Note: For more details on the Small and Medium-sized Enterprises Management Enhancement Act, please refer to the Small and Medium Enterprise Agency website's "Management Improvement Support" below. Also, for tax and financial support related to initiatives by small and medium-sized enterprises to introduce advanced equipment aimed at improving labor productivity and promoting wage increases, please see "Support through the Advanced Equipment Introduction System."

-

Small and Medium Enterprise Agency Website "Management Improvement Support"(External Link)

-

Small and Medium Enterprise Agency Website "Support through the Advanced Equipment Introduction System"(External Link)

Certification of Advanced Equipment Introduction Plan

In Inagi City, based on the "Small and Medium-sized Enterprises Management Enhancement Act," we accept and review certification applications for the "Advanced Equipment Introduction Plan" formulated by small and medium-sized business operators with offices in the city to improve labor productivity to a certain extent. Certification will be granted if it aligns with Inagi City's "Basic Promotion Plan for Introduction."

Basic Plan for Promoting Introduction in Inagi City

Small and Medium-sized Enterprises Eligible for Certification

The scale of small and medium-sized enterprises that can receive certification is as follows in the table below.

Please note that the scale requirements for tax support differ.

| Industry Classification | Amount of capital or total investment | Number of employees regularly used |

|---|---|---|

| Manufacturing and Others (Note: 1) | 300 million yen or less | Less than 300 people |

| Wholesale Industry | Under 100 million yen | Less than 100 people |

| Retail Industry | Under 50 million yen | 50 or fewer people |

| Service Industry | Under 50 million yen | Less than 100 people |

| Rubber Product Manufacturing Industry (Note: 2) | 300 million yen or less | Less than 900 people |

| Software Industry or Information Processing Services | 300 million yen or less | Less than 300 people |

| Inn Industry | Under 50 million yen | Less than 200 people |

- Note 1: "Manufacturing and others" refers to industries other than those from "Wholesale" to "Inn business" mentioned above.

- Note 2: Excludes the manufacturing of tires and tubes for automobiles or aircraft, as well as the manufacturing of industrial belts.

In addition, corporate unions, cooperative unions, and business cooperatives can also receive certification for advanced equipment introduction plans.

Contents of the Advanced Equipment Introduction Plan

To receive certification from Inagi City, eligible small and medium-sized business operators must formulate a "Advanced Equipment Introduction Plan" to improve labor productivity by an average of 3% or more compared to the base year (the most recent fiscal year-end) within the planning period.

The main requirements are as follows in the table below.

| Main Requirements | Content |

|---|---|

| Planning Period | 3 years, 4 years, or 5 years from plan approval |

| Labor Productivity | During the planning period, labor productivity is expected to be an average of 3% or more compared to the reference year (the end of the most recent fiscal year). Improvement [Calculation Formula] (Operating Profit + Labor Costs + Depreciation) ÷ Labor Input (Number of Workers or Number of Workers × Annual Working Hours per Person) |

| Types of Advanced Equipment, etc. | The following equipment directly provided for production, sales activities, etc., necessary for improving labor productivity [Types of Depreciable Assets] Machinery, measuring tools and inspection tools, equipment and fixtures, building ancillary facilities, software |

| Plan Details | It conforms to the national promotion guidelines and the basic promotion plan of Inagi City. It is expected that the introduction of advanced equipment and similar will be carried out smoothly and reliably. This is a plan that has undergone prior confirmation by certified management innovation support organizations (financial institutions, Commerce and Industry Association, professionals, etc.) |

Guidelines for Formulating Advanced Equipment Introduction Plans

Please refer to the following guidelines when formulating the introduction plan for advanced equipment, etc.

Application for Certification of Advanced Equipment Introduction Plan

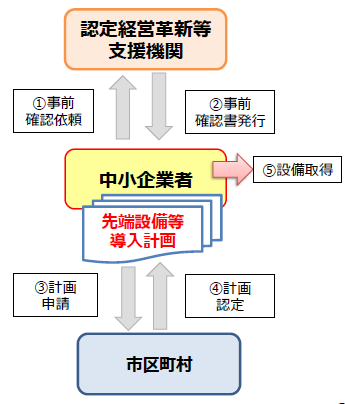

Flow of Certification for Advanced Equipment Introduction Plan

The process for the certification of advanced equipment introduction plans is as follows.

- Create the advanced equipment introduction plan and request prior confirmation from a certified management innovation support organization (financial institutions, Commerce and Industry Association, professionals, etc.)

- If the content is applicable, receive the issuance of a "Confirmation Letter" from the certified management innovation support organization

- Attach necessary documents such as the "Confirmation Letter" and apply to Inagi City for the introduction plan of advanced equipment.

- If the content is applicable, receive a "Certification Notification" from the Mayor of Inagi City

- After the issuance of the 'Certification Notification', acquire equipment based on the introduced plan for advanced equipment that has received certification.

- Note: It is essential to acquire advanced equipment after the certification of the "Advanced Equipment Introduction Plan," so please pay attention to the timing of acquisition.

- Note: When formulating the "Advanced Equipment Introduction Plan", please refer to the above "Guidelines for Formulating the Advanced Equipment Introduction Plan".

Confirmation by Certified Management Innovation Support Organizations

When applying for the "Advanced Equipment Introduction Plan," it is essential to obtain prior confirmation and the issuance of a "Confirmation Letter" from a certified management innovation support organization (such as financial institutions, Commerce and Industry Associations, or professional service providers) regarding the expectation that labor productivity will improve by an average of 3% or more annually through the introduction of equipment directly used for production, sales activities, and other necessary operations to enhance labor productivity.

You can check the Certified Management Innovation Support Organizations within the jurisdiction of the Kanto Bureau of Economy, Trade and Industry from the following Kanto Bureau of Economy, Trade and Industry website.

Documents for Submission of Certification Application

When applying for certification, please submit one copy of the following application documents.

(1) Certification Application Form [Form 22]

(2) Preliminary Confirmation Document by Certified Management Innovation Support Organizations

(3) Viewing and Copying Authorization for Municipal Tax Assessment and Payment Status

(4) Pledge Regarding Exclusion of Organized Crime Groups

Documents Required for Special Measures for Property Tax

In addition to the above (1) to (4), the following documents

(5) Confirmation document regarding the investment plan issued by the certified management innovation support organization

When introducing leased equipment and receiving reduction measures

In cases where the user of the facility and the bearer of the Property Tax are different (including cases where it is a transfer of ownership lease and the leasing company bears the Property Tax), in addition to the above (1) to (5), the following documents.

(6) Lease Agreement Estimate (Copy)

(7) Copy of the Property Tax Reduction Calculation Statement confirmed by the Public Interest Incorporated Association Lease Business Association

When declaring a wage increase policy (if you wish to receive a 1/2 or 1/4 reduction of the Property Tax)

In addition to the above (1) to (5) (for leases, (1) to (7)), the following documents.

(8) Document certifying that the wage increase policy has been communicated to employees

- Note: The wage increase policy can only be positioned within the plan at the time of new application.

- Note: If you wish to position the wage increase policy at the time of a change application, the special rate corresponding to the content of the wage increase policy will only be applied if the wage increase policy was positioned in the new application. However, equipment acquired based on the plan before the change will continue to be subject to the special rate before the change, even if a change application is submitted.

Various Application Forms

- Certification Application Form [Form 22] (Word 24.7KB)

- Preliminary Confirmation Document by Certified Management Innovation Support Organization (Word 21.4KB)

- Viewing and Copying Consent Form for Municipal Tax Assessment and Payment Status (Word 14.9KB)

- Pledge Regarding Exclusion of Organized Crime Groups (Word 14.7KB)

- Confirmation Document Regarding Investment Plan for Advanced Equipment, etc. (Word 31.3KB)

- Request for Confirmation Regarding Investment Plan (Word 21.2KB)

- [Sample] Request for Confirmation Regarding Investment Plan (PDF 370.0KB)

- Document Certifying Declaration of Wage Increase Policy to Employees (Word 18.3KB)

- [Sample] Document Certifying the Declaration of Wage Increase Policy to Employees (PDF 97.7KB)

-

Certification Application Form (For Change Application) [Form 23] (Word 22.4KB)

Documents Required for Application Changes

(1) Application Form for Certification (for Change Application) [Form 23]

(2) Advanced Equipment Introduction Plan (After Change)

- Note: Please prepare it by modifying the certified "Advanced Equipment Introduction Plan."

- Note: Please underline the changed or added parts to make the changes easy to understand.

(3) Preliminary Confirmation Letter by Certified Management Innovation Support Organization

(4) Copy of the Old Advanced Equipment Introduction Plan Set (Copy of the One Returned After Certification)

Note: Please indicate in the plan document that this is the plan before the changes, using handwritten notes or similar methods.

If it includes equipment subject to tax measures

In addition to the above (1) through (4), submission of the following documents is required.

(5) Confirmation document regarding the investment plan issued by the certified management innovation support organization

(6) Lease Agreement Estimate (Copy)

(7) Copy of the Property Tax Reduction Calculation Statement confirmed by the Lease Business Association

- Note: When receiving Property Tax reduction measures, if it is a finance lease transaction and the leasing company pays the Property Tax, (6) and (7) are also required.

(8) Document certifying that the wage increase policy has been communicated to employees

- Note: If you formulate a wage increase policy to raise wages by 3% or more after being certified with a wage increase policy to raise employer-paid wages by 1.5% or more, document (8) will be required.

Application Method

Reception Hours

From 8:30 AM to 5:15 PM

Application Method

Mail or Bring In

Submission Destination

Inagi City Hall Department of Industry, Culture, and Sports Economic Affairs Section Commerce Division

Points to Note

- It is essential to acquire advanced equipment after the certification of the "Advanced Equipment Introduction Plan." Please note that there are no exceptions that allow for plan applications to be approved after the acquisition of equipment.

- If there are no deficiencies in the submitted documents, the certificate will be issued in approximately 1 to 2 weeks.

- After the plan is approved, we may conduct surveys to understand the progress of the introduction plan for advanced equipment and other related matters.

- If there are changes to the plan (such as changes to equipment or additional acquisitions), it is necessary to obtain approval for the plan change. Please contact the Economic Affairs Section, Commerce and Industry Division, Department of Industry, Culture, and Sports, Inagi City Hall.

- Regarding financial support, the loan and guarantee examinations by financial institutions and credit guarantee associations are conducted separately from the certification examination of the advanced equipment introduction plan by the city. Even if you obtain certification for the advanced equipment introduction plan from the city, there may be cases where you cannot receive loans or guarantees.

Procedures for Receiving Special Measures for Property Tax

Documents Required for Special Measures for Property Tax

- Copy of the Certificate

- Copy of the certified advanced equipment introduction plan

Contact Information for Special Measures Regarding Property Tax

Inagi City Hall Department of Citizen Affairs Taxation Division Housing Section

To view the PDF file, you need "Adobe(R) Reader(R)". If you do not have it, please download it for free from Adobe website (new window).

Please let us know your feedback on how to make our website better.

Inquiries about this page

Inagi City Department of Industry, Culture, and Sports Economic Affairs Section

2111 Higashi-Naganuma, Inagi City, Tokyo 206-8601

Phone number: 042-378-2111 Fax number: 042-377-4781

Contact the Economic Affairs Section, Department of Industry, Culture, and Sports, Inagi City